Tesla Stock Soars After U.S. Election

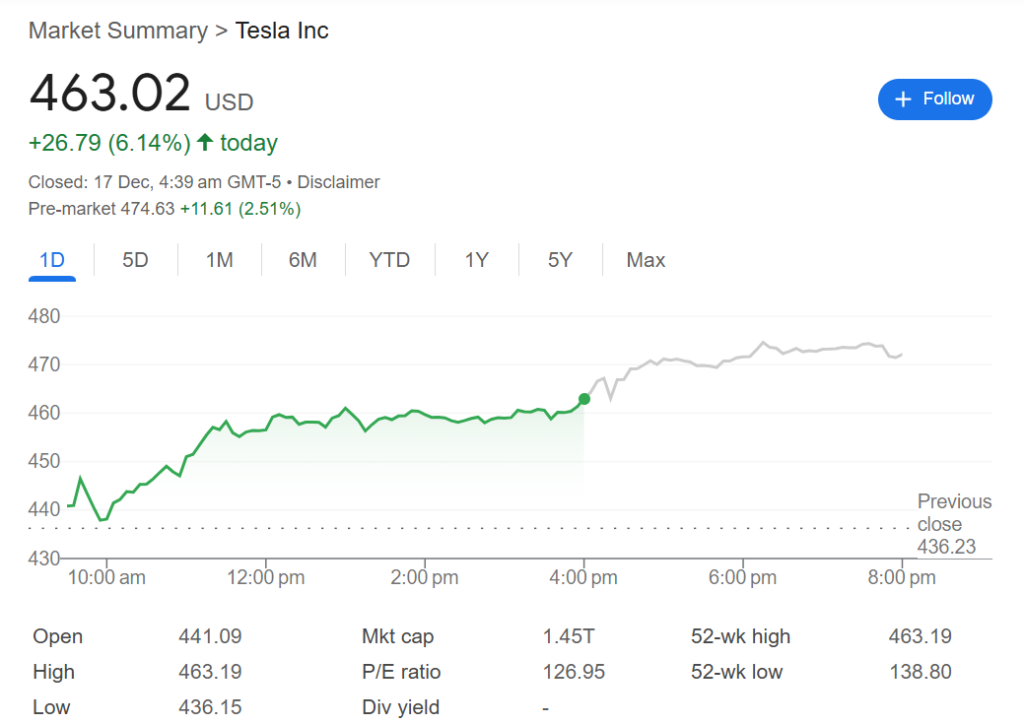

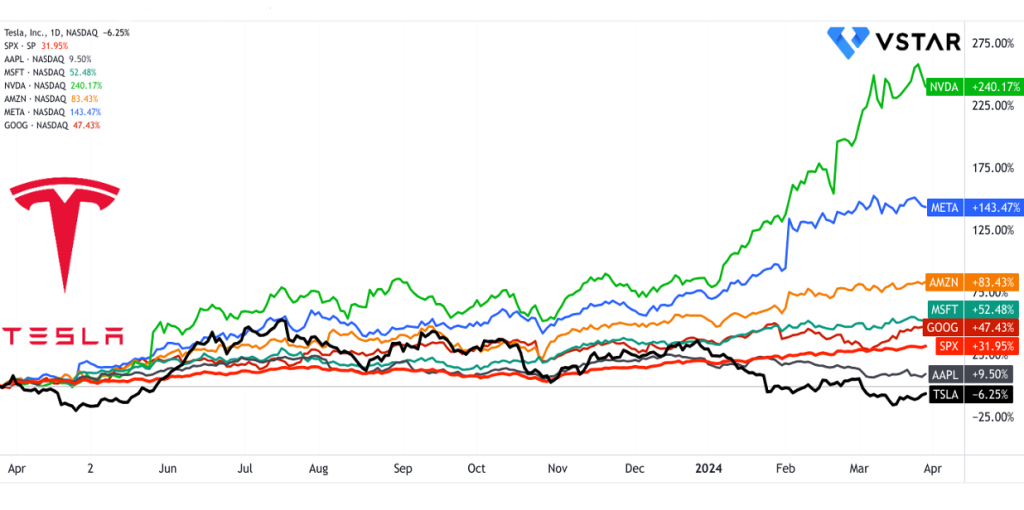

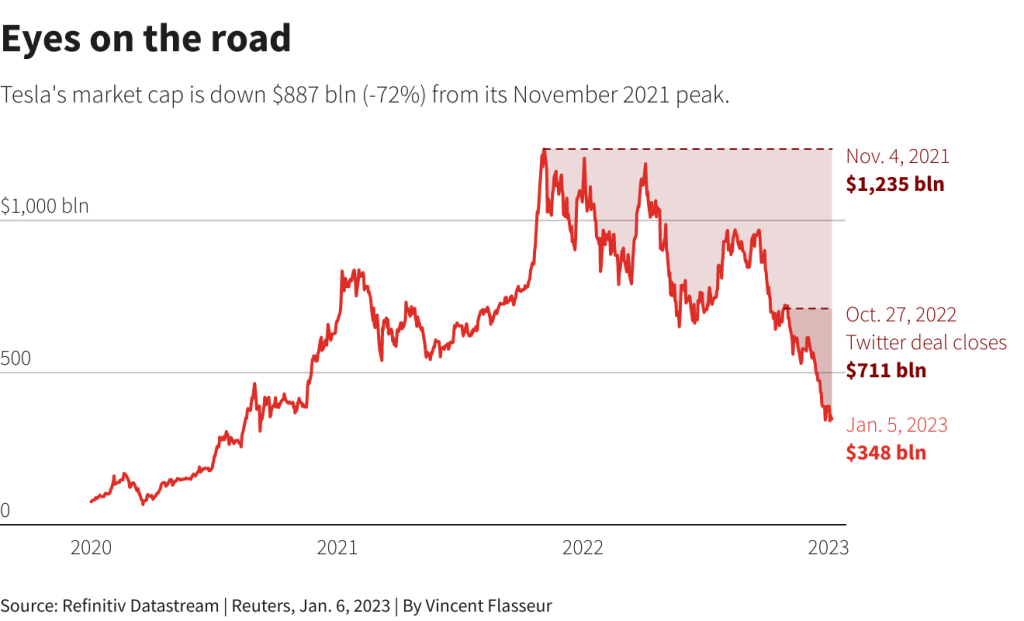

After the United States elections, Tesla’s stock saw advances of over 80% and recently reached the all-time high. Shares were up by 5.6% as of 3:25 p.m. EST this afternoon. Wedbush analyst Dan Ives increased his price target for Tesla stock by $115 a share to $515, the highest among all targets on Wall Street. Ives believes that the reason behind why the recent

The Impact of Trump’s Election

Chief of Tesla CEO Elon Musk initially supports Trump before the election but recently added to his advisory team; such appointment is said to be the “total game changer” for Tesla stock and even the story of autonomous/AI for Tesla. Many analysts believe Tesla stock should, in a way, valuate its self-driving future income than its current cars sold. Ives suspects that this technology will spread faster with the Trump government, therefore, benefiting .

Future Outlook of Tesla Stock

Ives believes Tesla stock will not end at $515. He thinks FSD can take Tesla’s valuation to over $2 trillion within the next 12 to 18 months, thereby bringing the stock price around $625 per share by mid-2026. Musk has said that only people who think it will solve autonomous driving issues should have the stock. The firm keeps coming out with its software upgrades that demand driver presence which will also work to lift .

Market Mood is Driving Tesla Stock.

Now might be the right moment when the Tesla technology hit the road with upgraded ones, coupled with a supportive administration, and this pushed more investors to invest into as per the Ives’ report.

Tesla Stock Takeaways :

Tesla shares soared to a new all-time high as they sustained their post-election rally following the upgrading of price target by Wedbush. Their movements have been quite steep, but relative strength index signals rather overbought conditions that could lead to a short-term profit-taking. Key support levels nearby are $360, $300, and $265 on Tesla’s chart which investors would watch closely.

Technical Analysis of Tesla Stock

Since breaking out from an ascending triangle, it has trended higher with increasing trading volumes. Relative strength index confirms the bull trend but also signals that conditions are overbought and doors are open to short-term profit-taking. From technical analysis, the stock will have a bullish target at about $510.

Trend and Expectations among Investors

Key levels that investors should keep an eye on on the chart of Tesla include near $360, $300, and $265. These can present a good buy during any pullback in the market. The bull trend in the stock of Tesla is going to last until the firm’s innovative technologies and good market conditions exist.

Significant Developments and Projections

Wedbush Inc. upped the target on Tesla to $515 from $400 proclaiming it a possible high of $650 by the end of the next year. The investment firm believes that the incoming Trump administration will boost Tesla’s self-driving and AI initiatives, further enhancing the stock’s value.

From the beginning of the year through Monday’s close, that’s about an 85% hike in Tesla’s stock price; most of that occurred after the November 5 election, and investors remain hopeful on possible easy approval processes by Musk given his very close relationship with Trump. So, in these latest highs, there is, more than profit-taking, a significant resistance level to watch.

Optimistic Future for Tesla Stock

The stock price of Tesla increased by almost 85% since the beginning of this year through Monday’s close with most of it gained

3 thoughts on “Tesla Stock Soars 80% Post-Election: Future Projections and Market Analysis”