EUR/USD Trading Under Pressure

EUR/USD trading remains on the back foot near psychological resistance of 1.0500 on Tuesday. Major currency pair is fragile. Expectations that the Federal Reserve, or Fed, will become slightly hawkish push the US Dollar forward.

Fed’s Stance and Impact on EUR/USD

The expected Federal Reserve policy for reducing rates on the benchmark borrowing facility will occur on Wednesday, and the reduction is to be anticipated at 25 basis points (bps) reducing the rate to 4.25% – 4.50%. It has just gone up on the dollar index (DXY), which measures the dollar value against the value of six major currencies outside the dollar, above the 107.00 mark. The market included a 25-bps dissipation already for the Wednesday policy meeting. All this will be directly affecting the activities of the euro to the US dollar.

EUR/USD from Analyst’s Perspective

Analysts at Macquarie said the Fed’s stance could turn “slightly hawkish” from “dovish.” Recent slowdown in the pace of US disinflation and low unemployment contribute to this more hawkish stance. The shifts are critical for EUR/USD trading.

Economic Data Influence on EUR/USD trading

US monthly Retail Sales for the month of November have arrived better than their forecast. Retail Sales, now one of the most accepted gauges of consumer outlays, rose 0.7%, faster than predictions and the prior release was 0.5%. The economic strength is, in fact, reflected on EUR/USD trading data.

ECB’s Cuts on Interest Rates: EUR/USD trading

There are reasons for the Euro’s EUR outlook to be bearish in light of the expected European Central Bank’s action in cutting interest rates every month up to June 2025. Such developments, however, will be heavily influencing the EUR/USD trade.

ECB Monetary Policy Influence on EUR/USD trading

The ECB has delivered a 100-bps interest rate cut this year. It is likely to ease its monetary policy by a similar amount next year. Officials are sanguine about Eurozone inflation returning to the target of the central bank, which is 2%. These policy moves shape the landscape of EUR/USD trading.

ECB Officials’ Remarks on EUR/USD trading

One of the common characteristics of a thriller thriller is that it heightens the level of excitement through adding a lot of unexpected twists and turns. Such is the case with ECB President Christine Lagarde and executive board member Isabel Schnabel on the need for more interest rate cuts in the powerfully euro-us view of the trading market. Undoubtedly, the fear has set in among the ECB policymakers on the rising economic risks emanating from weaker demand and possible tariffs from the incoming president-elect Trump of the United States.

Political Developments Affecting EUR/USD

The parliamentary vote of Germany on a no-confidence motion against the Scholz government has paved the way for Germany to general elections on the 23rd of February. Political movements influence the target curtailment of the EUR/USD through the changes in market sentiments.

German Economic Statistics and EUR/USD

German IFO sentiment surveys for December were less-than-expected. Business Climate was at 84.7, and Expectations at 84.4. IFO Current Assessment increased to 85.1 from 84.3 in November. Such data is critical in EUR/USD trading, as it reflects the state of the economy.

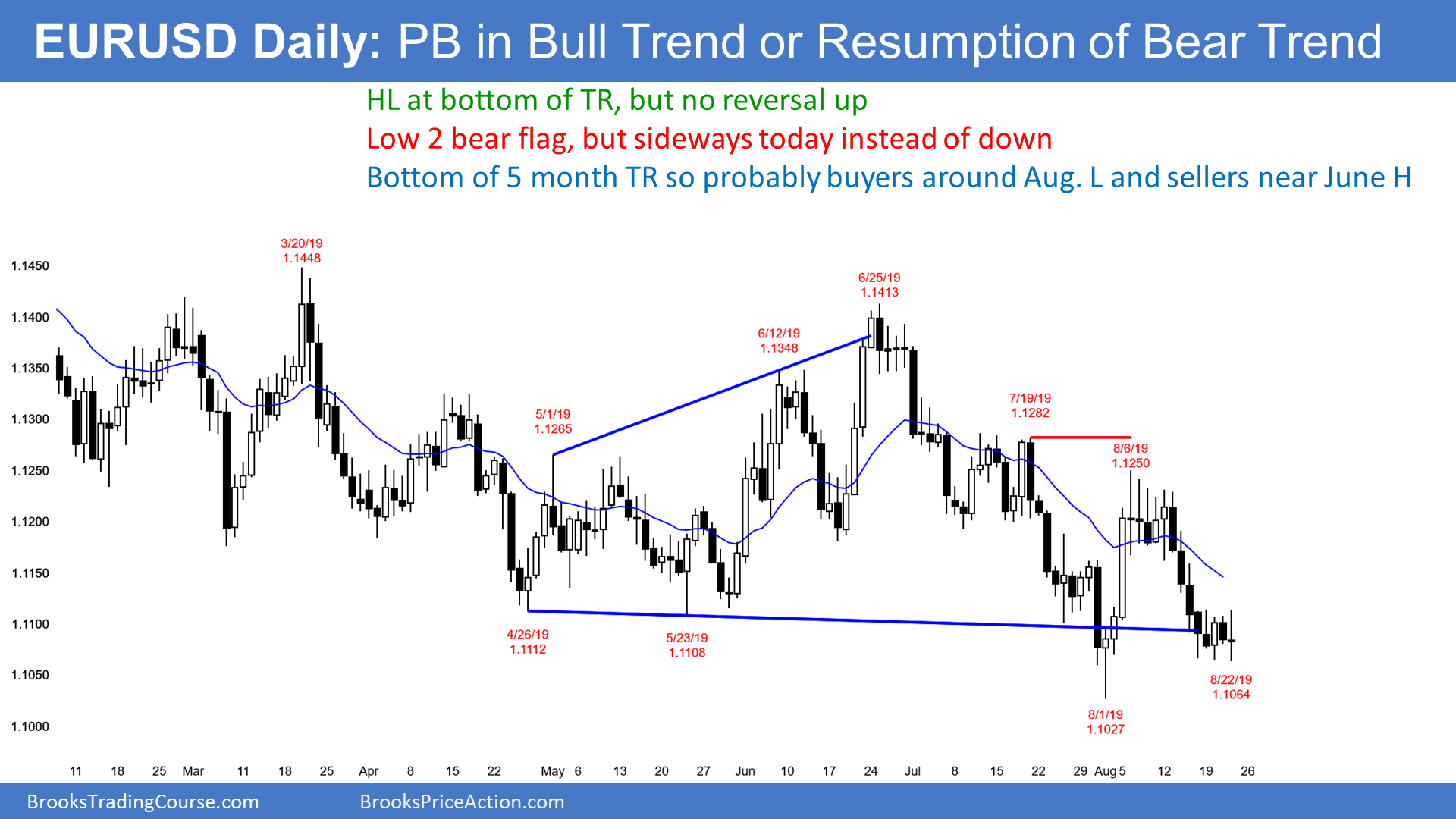

Technical Analysis for EUR/USD

The EUR/USD pressure is continued for the last four trading days around the psychological amount of 1.0500. The pair reflects an upward pattern from resistance near the 20-day Exponential Moving Average (EMA), with an exchange value of 1.0540. At present, the near-term trend with respect to EUR/USD trading has been a bearish perspective.

Indicators Supporting Analysis

The 14-day Relative Strength Index (RSI) comes around 40.00. The bearish power should activate if the RSI (14) creeps below 40.00. The critical support will be the two-year low of 1.0330; while the 20-day EMA would be the major resistance for Euro bulls. These indicators are necessary for trading strategies concerning EUR/USD.

ECB’s Future Interest Rate Cuts and EUR/USD

The European Central Bank is most likely to lower its interest rate further if inflation is considered to have reached its targeted 2%. ECB head Christine Lagarde and policy hawk Isabel Schnabel sealed a market bet for further modest reductions in the euro zone’s borrowing cost. EUR/USD trading projections thus get affected.

Impact on EUR/USD on Eurozone Inflation

Inflation in the euro zone was 2.3% last month. The ECB expects it to settle at its 2% target next year after hitting double digits following Russia’s full-scale invasion of Ukraine in 2022. Such economic conditions influence EUR/USD trading trends.

ECB’s Policy Outlook and EUR/USD

ECB officials are forthright regarding the course of monetary policy. It’s going to cut further down in interest rates if data kept streaming in would continue confirming the baseline. Price stability can be had, and some slow-rate cuts could very well follow. It’s very relevant for analysis trading of EUR/USD.

Strength in US Dollar and EUR/USD

The euro weakened against the US dollar, as on Wednesday, it saw the release of US CPI data. It fell for the fourth successive trading day to almost a low of 1.05, a level since 2 December. These movements are essential for the trading of EUR/USD.

US Inflation and EUR/USD

US headline inflation reached 2.7% year-over-year in November from 2.6% previously in the month. Core inflation stood at 0.3% on a month-over-month basis and at 3.3% year-over-year. This further strengthens expectations that the Fed will do its third cut in December, hence impacting EUR/USD trading dynamics.

European challenges for EUR/USD

While the euro seems to be set for future downswings, it lacks much in terms of potential upside. Down by almost 4% against the US dollar since early November, Europe’s single currency has had its problems with global tariff threats from President Trump’s administration. On the home front, the persistent political uncertainties and dwindling growth in the economy continue to challenge euro competitiveness, thereby affecting the trading within the EUR/USD pair.

Future Projections for EUR/USD

The ECB will probably maintain its slow pace on rate cuts. Markets anticipate a 25 basis point cut later today. Other analysts say that the bank might have to step up the easing cycle in 2025. These projections are important for trading strategies of EUR/USD.

Political Uncertainties and EUR/USD

Political uncertainty in Germany and France as right-wing parties gain significant power. Chancellor Olaf Scholz has sought a confident vote in parliament that could lead to an early federal election next year. These developments are important for EUR/USD trading dynamics.

Bond Yields and EUR/USD trading

Germany and France government bond yields declined sharply since late November. The reason behind this is high expectation by the ECB to cut deeper into the rates. The 10-year government bond yield spreads between the two countries have increased significantly, signaling market sentiment. These movements in yields are crucial in the analysis of EUR/USD trading.

Conclusion on EUR/USD Outlook

At the same time, yield on the US 10-year government’s bond remained at a high rate of 4.29% while investors continue to lure with another divergent movement. This brings forth the euro further down and may have a significant effect on EUR/USD trading.

if you want to see the news about EUR/USD Trading: Market Analysis, Federal Reserve Decision Impact

if you want to see the news about Tesla Stock Soars 80% Post-Election: Future Projections and Market Analysis

1 thought on “EUR/USD Trading: In-Depth Analysis and Market Insights”