Cautious EUR/USD Trading Ahead of Fed Decision

EUR/USD trading is neutral around 1.0510 as market participants adopt a cautious stance ahead of the Federal Reserve’s upcoming decision on interest rates. With the December meeting set to begin tonight and conclude tomorrow, all eyes are on the potential rate adjustment.

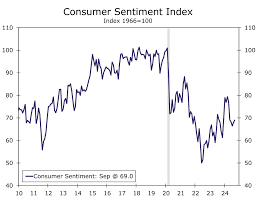

Expected Rate Cut and Market Sentiment

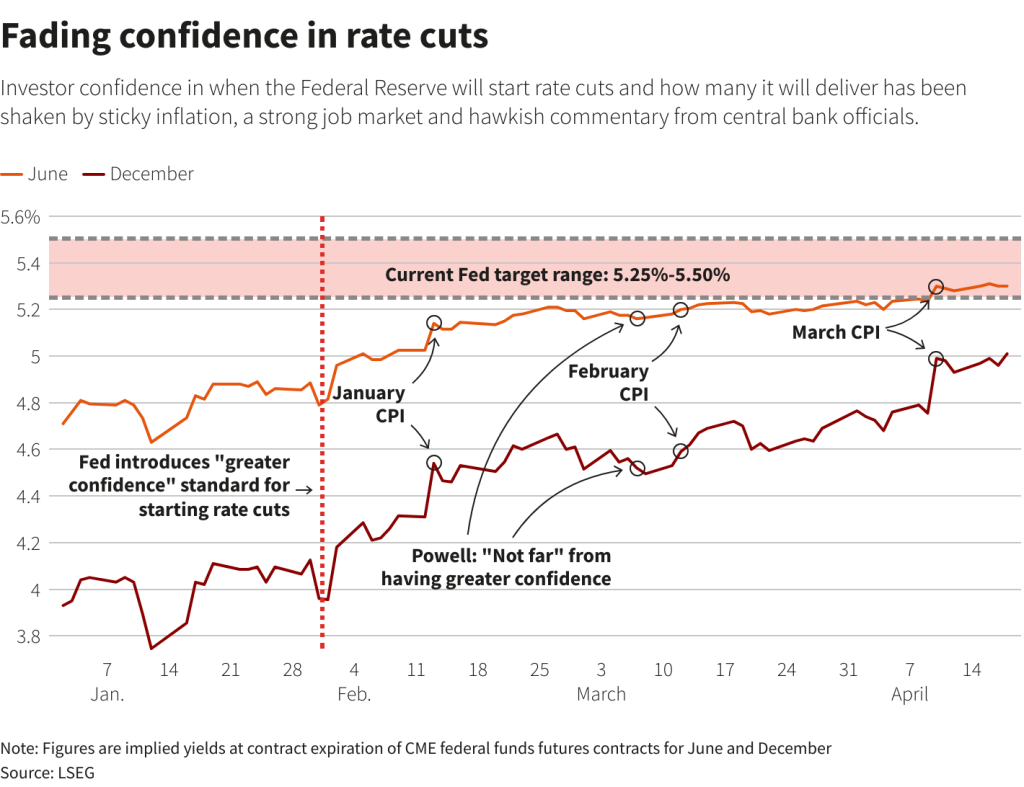

The general expectation in the EUR/USD trading is a 25 basis point cut, which is factored in by market consensus at a 94% probability. Moreover, there is a 37% chance that this could be the last cut or that rates may not be altered at all in 2025, and this has added to the market’s nervousness.

Inflation Fears Hang Over 2025

The looming concerns of inflation during 2025 are also because of uncertain policy decisions as well as economic stimulation measures, thus the Fed would communicate a more cautious tone, aiming to have more flexibility to respond accordingly with changing economic indicators, impacting trading on the EUR/USD.

Focus on Economic Indicators

Today, the market’s attention is also focused on the US’s November Retail Sales and industrial production data. The numbers are essential in evaluating how the US economy is at present and could affect how the Fed decides to conduct its policy, thus influencing trading in EUR/USD.

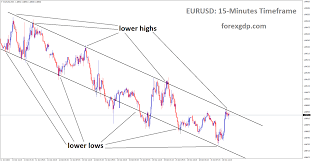

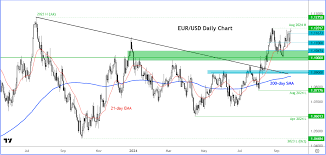

EUR/USD Trading Technical Analysis

EUR/USD has just completed a correction wave at 1.0533 and is likely headed south to 1.0420. After the latter target, a corrective swing to 1.0475 is expected. And after the correction, another slide to 1.0340 may start.

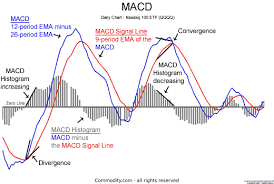

MACD Indicator Supports Bearish Outlook

The MACD indicator strengthens this bearish perspective for EUR/USD trading. Its signal line is below zero and trends downward, indicating further decreases. This analysis is significant for the traders who observe the trading trend of EUR/USD.

EUR/USD Trading Short-Term Movement (H1)

The H1 EUR/USD is trading below 1.0533 and initiating a downward wave to the area of 1.0485, where there would be a range formation to break down.

A possible move below it would push lower.

The stochastic oscillator remains on the sell side and confirms bearish momentum The Stochastic oscillator also confirms this scenario for EUR/USD trading because its signal line is at the moment below 50 and expected to go further down towards 20. This shows that the bearish momentum is to continue.

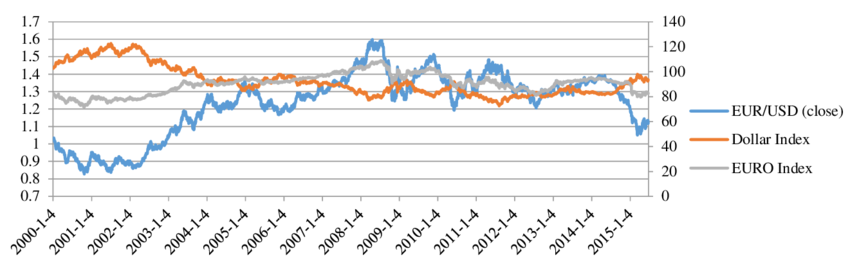

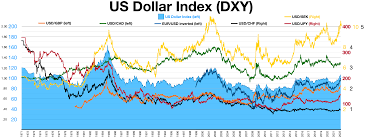

U.S. Dollar Performance and EUR/USD Trading

NEW YORK, Dec 17 (Reuters) – The US dollar advanced against major currencies Tuesday following stronger-than-anticipated retail sales data, demonstrating underlying economic strength. It is in the EUR/USD trade, however, where markets had braced themselves for interest rate movements coming from the Federal Reserve and other central banks.

Fed Rate Cut Expectations

Markets expect the Fed will deliver a 25-basis-point interest rate cut at the end of its two-day policy meeting on Wednesday, with futures implying a nearly 97% chance of a cut, according to the CME’s FedWatch tool. This scenario significantly impacts EUR/USD trading.

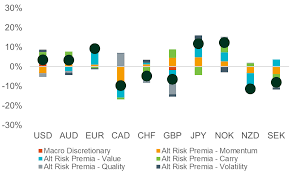

Performance of the U.S. Dollar and Other Currencies

Against the Swiss franc, the dollar edged lower by 0.2% to 0.89270 in choppy trading, after hovering near its highest level since July. The euro, which is heading for a drop of nearly 5% against the dollar this year, was down 0.24% at $1.048825. These are critical movements for EUR/USD trading.

Global market reactions to dollar movements

“But actually, the market is currently debating whether it is the time to fade the dollar that enjoys an incredible run this very year,” says Marvin Loh, senior global market strategist at State Street in Boston. Such talks are vital for understanding dynamics on EUR/USD trading.

Currency Performance Insights

Gains in the pound sterling against the dollar were on the back of data showing higher-than-expected wage growth in Britain for the three months to October. Such movements are particularly relevant for the upcoming decision by the Bank of England on Thursday on interest rates. Such important movements will also be analyzed for the adoption of trading strategies in EURUSD.

Asian Currencies and EUR/USD Trading

Yen strengthened against the dollar as markets revised their expectations on this week’s Bank of Japan interest rate hike, now favoring January instead. Now it trades lower by 0.42% at 153.52 per dollar. Such movements can indirectly affect the Euro against the dollar trading.

Performance of the Chinese Yuan and other currencies

The dollar dropped 0.06% to bring to neck the offshore Chinese yuan by 7.287, reflected in the gloomy expectations pinned for Chinese economic growth that locked 10-year bond yields near their record lows. The Australian dollar fell 0.6 from the greenback to $0.6332 while it weakened against the Swedish crown by 0.76 compared to the dollar to 10.964. These currency performances are significant elements in a comprehensive EUR/USD trading strategy.

Performance of Bitcoin and Its Importance

Bitcoin reached a high of $108,379.28 before paring gains and trading near the $110,000 mark. It rose 0.68% to $106,798.26. These movements may not be directly related, but they do reflect broader market trends that can impact trading sentiment in EUR/USD.

Eurozone Economic Outlook and EUR/USD Trading

The euro hovered around the $1.05 mark and came close to the two-year low of $1.04 reached at the end of November, waiting for the traders to gauge the economic, political, and monetary outlook of the Eurozone-an important aspect of trading EUR/USD.

Impact of Political Uncertainty on EUR/USD Trading

Flash PMIs showed a slower contraction in private sector activity, with the rebound in services, though manufacturing remained subdued. Still, the largest economies in the bloc, Germany and France, continued to underperform. Such political uncertainty is important for EUR/USD.

Monetary Policy and Future EUR/USD Trading

On the monetary front, the Fed is likely to cut rates by 25bps this week and signal a slower pace of reductions in 2025. The ECB went ahead with its fourth 25bps rate cut last week, remaining cautious about further easing. Analysts think that the ECB may need to speed up policy loosening to support the fragile Eurozone economy,

you can also like to read this

Tesla Stock Soars 80% Post-Election: Future Projections and Market Analysis

1 thought on “EUR/USD Trading: Market Analysis, Federal Reserve Decision Impact”