Ripple’s Legal Future and SEC Legal Impact on XRP

Key Takeaways Ripple’s legal future depends on the SEC’s decision on January 15 appeal. Traders are looking for possible price movements. Dragonchain seeks a stay of the SEC lawsuit based on changes in leadership and enforcement priorities. BTC bounces to $98k as softer U.S. inflation data improves crypto market sentiment ahead of the holiday.

SEC vs. Dragonchain: Ripple Appeal and Broader Implications

On Friday, amicus curiae attorney John E. Deaton shared a court filing in the SEC vs. Dragonchain case. This filing criticized the agency’s aggressive tactics by stating, “SEC’s bully tactics continue in non-fraud crypto cases against American entrepreneurs.”

SEC’s Intentions and Dragonchain’s Defense

In 2022, the SEC filed suit against Dragonchain for unregistered crypto asset security offerings. Case continues despite Chair Gensler’s departure, proof of the SEC’s perseverance. Dragonchain filed for a stay in court in light of the impending transition in SEC leadership and in enforcement priorities.

Former SEC Chief Critiques Gensler’s Legacy

Former SEC Office of Internet Enforcement Chief John Reed Stark blasted Chair Gensler and the tactics of the agency. In fact, Stark believes new leadership at the SEC would likely end the active investigations and litigation. Thus, Reed Stark concluded that Gensler’s actions brought the bold approach of the SEC into focus.

Ripple’s Legal Battles And XRP Price Trends

Ripple’s legal battles are one of the leading drivers for XRP. On December 20, XRP rose 1.83%, partially retracing Thursday’s 3.10% loss. Here is how the SEC next move will determine XRP’s future, along with price targets and impacts.

US Personal Income Report Drives BTC Rebound

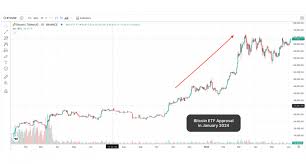

On Friday, bitcoin, BTC, slipped $92,074 on pre-holiday profit-taking, but the U.S. economic data also catalyzed a broad-based crypto rebound, forcing BTC to take back the $98k handle. The flow trends in the BTC-spot ETF market remain pivotal for understanding BTC’s supply-demand dynamics.

ETF Market Outflow Impact on BTC Demand

On December 19, the US BTC-spot ETF market recorded net outflows of $671.9 million. Even with net outflows, BTC-spot ETF inflows remain impressively strong, and may continue to run for three weeks. The significance of the BTC and ETH-spot ETF markets continues to grow.

Bitcoin Price Outlook and Market Sentiment

Near-term BTC price trends are dependent on sentiment towards the Fed rate path, US BTC-spot ETF market flow trends, and US government BTC sales. A significant BTC sale may push BTC towards $90,000. Conversely, progress toward an SBR may drive BTC toward $100,000.

Market Outlook for XRP and BTC

XRP and BTC are at critical junctures. The future of XRP will depend on the next move by the SEC. BTC is still sensitive to ETF flows and macroeconomic developments. Stay updated with our latest market analysis and expert insights for the SEC legal impact on XRP.

Ripple’s Consolidation and Future Projections

Ripple is holding above $0.20, consolidating above the level. Buyers are looking for holding bullish pressure to take it towards $0.21. The legal battles in Ripple and SEC decisions are critical in XRP’s price movements.

Cryptocurrency Industry Overview and XRP Ledger

The XRP Ledger, or XRPL, continues to evolve with new features and upgrades. Most of the upgrades require an 80% majority vote for two weeks. XRP Checks, like traditional banking checks, wait for validation. This feature will enable XRP users to send and receive funds synchronously.

#CryptocurrencyNews #XRP #SECvsRipple #CryptoMarket #BTC #Dragonchain #LegalImpacts #MarketTrends #Blockchain

Related News

Tesla Stock Soars 80% Post-Election: Future Projections and Market Analysis

Bitcoin Skyrockets to $107,000: Market Reactions and Future

Significant Growth in Bitcoin (BTC) Beyond 106K Due to Hopes of Federal Reserve Cutting Rate.

3 thoughts on “SEC Legal Impact on XRP: Ripple’s Legal Battles and Market”