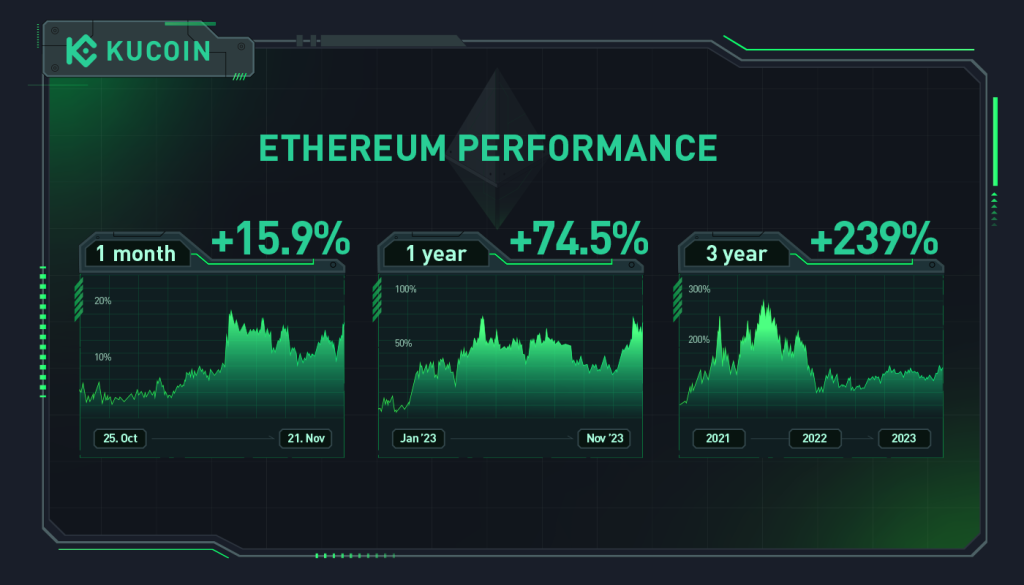

Recent Ethereum Price Trends

The Ethereum price has been thrilling to watch lately, with initial struggles to keep up with large-cap cryptocurrencies. However, the recent week has been tough for the crypto market. Ethereum’s value declined by over 12%. The price movement of Ethereum has been closely monitored by investors and analysts, reflecting the volatility and rapid changes in the crypto market.

Effect of US Federal Reserve Decisions

It’s a combination of a downfall in the price of Ethereum and the US Federal Reserve cutting interest rates. The said price performance has also been attributed to the launch of spot ETH exchange-traded funds (ETFs).

The cut has profound effects on market sentiment, both at the traditional and crypto markets, due to the decisions made by the Federal Reserve. Investors usually adjust their portfolios in accordance with changes in rates, and such actions lead to movements in asset prices-in this case, Ethereum.

Spot ETH ETFs Break Positivity Inflows Streak

Spot Ethereum ETFs, operating in the US, report a net outflow of $75.11 million as of December 20 from SoSoValue. That marked the first negative in a row for the products. The outflow thus indicates a change in sentiment among investors and may raise questions about the future movement of the market. Their inflow and outflow trends are useful indicators to predict future price action in the market.

Negative day of December for the ETH ETFs

On 19 December, the Ethereum ETFs suffered a net outflow of $60 million. That marked the end of 18 days with positive inflows to those products. Such streaks are one of the very important signs of the direction of market trends: insights into how investors behave and, consequently, market sentiment. It may now mark the beginning of change in investors’ perceptions regarding Ethereum in their portfolios.

Major Performance of Ethereum ETFs

The BlackRock’s Ethereum Fund, abbreviated as ETHA, recorded outflows for the first time on December 20, as it remains the only spot ETF. The fund posted almost $103.7 million by week-end. Major funds like those of BlackRock often act as the lead in shaping the trend among smaller funds and individual investors, making them alter their decisions and strategies. Tracing such major players is essential for understanding market dynamics.

Inflow Trends for Fidelity and Grayscale ETFs

Fidelity’s Ethereum Fund (FETH) had $12.95 million in net inflow on December 20. Other positive inflows came from Grayscale’s Ethereum Trust (ETHE) and Mini Trust (ETH). These positive inflows stand in contrast to the general negative trend, thus revealing selective optimism among certain funds. The varied performance of different ETFs points out the complex and multifaceted nature of the market.

Overall Ethereum ETF Performance

The Ethereum price and ETFs had back-to-back negative performances, with a net $135 million outflow in two days. But the weekly net inflow remained positive. This resiliency indicates that market sentiment is balanced, such that short-term fluctuations are not decisive of long-term trends. The fact that the market can sustain positive weekly inflows despite daily setbacks speaks to underlying strength and investor confidence.

Investor Sentiment on Ethereum ETFs

Despite the recent outflows, the Ethereum price and ETFs closed with a fourth consecutive week of positive net inflows at $62.73 million. Investor sentiment is critical in deciding the direction of the market. The positive weekly net inflows indicate that although caution is there, faith in Ethereum’s long-term potential is still ongoing. Analyzing sentiment helps understand the broader market context and future expectations.

Bitcoin ETF Trends

Similar trends were witnessed in spot Bitcoin ETFs, as most funds registered outflows worth around $276 million on December 20. This comparison between the trends in Ethereum and Bitcoin ETFs gives a broader picture of the cryptocurrency market. Outflow patterns in these major cryptocurrencies point to a relatedness in these cryptocurrencies, given their shared market influences.

Ethereum Price Now

As of now, the Ethereum price is traded at around $3,342. This reflects an 2.4 percent decline in 24 hours. Return to positive inflows of ETFs is likely to provide some temporary relief to the Ethereum prices. The current price action is vital for making the informed investment decisions. The knowledge on these trends helps investors navigate the moves of the market more astutely.

Factors Influencing Ethereum Price

Despite recent declines, watching the Ethereum price has been exciting. US Federal Reserve decisions and ETF performance have, in fact, affected this market significantly. Other such factors include changes in the regulatory environment, technological up-gradation, and other market sentiments. All such influences are crucial for getting updated and making strategic choices for investment.

Future Predictions of Ethereum Price:

Spot ETFs will have to maintain the inflows at positive levels to stabilize the price of Ethereum. Investors will be very keen on how the major ETFs perform to gauge future market directions. To predict the future, there is a need to understand past and present trends in detail. Growth potential is still high if the market can overcome the short-term hurdles.

Market Strategies and Investor Behavior

Understanding market strategies and investor behavior helps in predicting future trends in Ethereum price. Investors are adapting to changing conditions, making strategic decisions based on current data. This adaptability is key to navigating the volatile crypto market. Analyzing market strategies offers insights into how different players approach the market, which can inform personal investment decisions.

Conclusion on Ethereum Price Trends

Ethereum price was always a target for the investors. ETF performances in recent days, Federal Reserve policies and market moods affect price trends. What it takes to succeed in the crypto world is awareness and sound decision-making strategies. To understand what is going on and thereby making smart choices is the necessary key factor for survival and for doing well in this volatile area.

#EthereumPrice #CryptoMarket #ETFs #FederalReserve #ETHPriceTrends #EthereumInvesting #MarketSentiment #InvestorStrategies #CryptoInvesting #BitcoinComparisons

2 thoughts on “Ethereum Price Trends: Impact of Federal Reserve Decisions”