Nvidia-An Unstoppable Force in the AI Market

Nvidia (NVDA) has had the most exceptional year ever, with its revenues and stock price sky-high. The investment in AI technology has been very profitable and has taken advantage of generative AI. Its market cap has often taken the lead of Apple’s market cap and has passed over $3 trillion at its peak. CEO Jensen Huang is one of the most sought-after executives in Silicon Valley and meets world leaders and other tech luminaries.

Dominating the AI Market

Nvidia continues to make strides in the AI market with its powerful Blackwell chip for AI applications. The company expects to ship billions of dollars worth of these chips in the fourth quarter alone, with much more to come throughout the year. The Blackwell chip is well-liked within developer communities, a testament to its robust hardware and software integration.

Nvidia’s Competitors and Market Share

Despite Nvidia’s leadership, competitors like AMD (AMD) are not sitting idle. They want to capture some of Nvidia’s 80%-90% market share. Even some of Nvidia’s customers are designing their own chips to reduce dependency on semiconductors.

Wall Street Faith in Nvidia

While the latter trades down 1% in premarket trading this morning on a weak guidance, Street acceptance of Nvidia’s successes remain upbeat. Another AI champ stock is Broadcom (AVGO), which designs its wares with Google, its stock has rocketed to 113% in its year-to-date total to date.

It demonstrates its rich market for Nvidia still at the top spot.

Holding the AI Crown

Early investment in AI software helped Nvidia gain first-mover advantage in the AI market, making its graphics chips a powerful processor. Hyperscalers like Microsoft, Google, Amazon, and Meta keep buying Nvidia chips in large quantities. Total revenue reported by Nvidia is $35.1 billion, out of which $30.8 billion is from its data center business.

Nvidia’s Strong Software

“Nvidia really has the hardware and software for the AI computing era,” said Futurum Group CEO Daniel Newman. Nvidia’s CUDA software is essential for building applications for its chips. This software’s popularity ensures remains a key player in the AI market.

Future Prospects for Nvidia

It is likely to provide much of the muscle powering the AI industry in 2025. The company’s Blackwell chip, which follows in the footsteps of its Hopper line, is going into production. Customers are adding new cooling capabilities to data centers to handle the heat these processors generate.

Nvidia Faces Challenges

While Nvidia will surely hold onto its AI Crown, some challengers are rearing up. AMD, Intel both have products looking to disrupt Nvidia’s status quo. AMD’s MI300X chips are there to cut down on its competitor H100 Hopper chips in it. With Intel having a turnaround nightmare.

The Market Strategy in Nvidia

Nvidia’s customers are designing their own AI chips to reduce dependence on Nvidia. Google has its Broadcom-based TPU chips, Amazon has its Trainium 2 processor, and Microsoft has its Maia 100 accelerator. This competition is a testament to the dynamic and competitive AI market landscape.

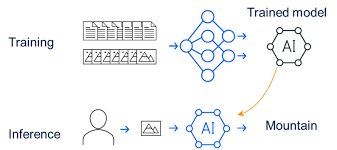

Shifts in AI Workloads

There is concern that the shift to inferencing AI models will reduce the requirement for Nvidia chips. However, training AI models consume a lot of chips and energy, whereas inferencing consumes less. Still, according to the CEO, Jensen Huang, the chips from Nvidia are just as good at both tasks.

A Bright Future for Nvidia

Even if Nvidia’s market share slides, it doesn’t mean its business will suffer. “This is definitely a case of raising all boats,” said Newman. The competition will build a bigger AI market pie, benefiting everyone, including it.