Stocks Plunge in Last Week of 2024

The S&P 500 was pushy on Monday, keeping up the trend of major indexes meeting declines in the last week of the year. The benchmark S&P 500 fell by more than 1%, followed by the Nasdaq Composite as it dove down by 1.2%. The Dow Jones Industrial Average slid down at around 0.8%, taking a picture in very large size of the stock market.

Significant Technology Impact on Stock Market Performance

Decline in stocks after the yield on the 10-year Treasury slumped from a seven-month high to near 4.55%. The decline in stocks was also contributed by Big Tech names, like Tesla and Nvidia, which have helped drag the Nasdaq Composite down 1.5% last Friday and the S&P 500 more than 1% lower.

Santa Claus Rally Fails to Materialize

Though this is one of the best consistent seven-day positive stretches in the S&P 500, the long-awaited “Santa Claus” rally does not seem to take place. Historically, it had risen 1.3% during the seven trading days beginning December 24. However, the current period has seen a fall in nearly 1% in S&P 500.

Year-End Hope for Recovery in the Markets

Hope floats on the markets catching in all the remaining gains that are left by only two trading days before 2024 goes out. The S&P 500 added more than 25% this year alone. The Nasdaq Composite added more than 30%, while the Dow Jones managed a mere 14% of stock market returns.

Day of Mourning for former President Carter

The New York Stock Exchange and the Nasdaq have also announced that they are closing trading on Thursday, January 9, to show mourning for former President Jimmy Carter, who passed away at the age of 100. This goes to show the regard and recognition accorded to solemn national events that affect the performance of stock markets.

Strategists remain optimistic despite lack of rally

Despite the absence of a “Santa Claus” rally, Wall Street strategists seem to be optimistic about 2025. Citi US equity strategist Scott Chronert and Fundstrat head of research Tom Lee say that the fundamentals that led to the market rally remain in place. He advocates buying on pullbacks during the first half of 2025.

Ackman’s Impact on Fannie Mae and Freddie Mac

Incorporating a turnaround mantra from the mouths of billionaire investors, shares stumbled almost 30% across giant Fannie Mae, Architts Inc., and others on Wednesday as a flock flew by another pronouncement by US economist Bill Ackman on what the investor considers as a faint possibility of freeing the two mortgage giants from conservatorship. Such a phenomenal uplift again begs the question whether sharing-of-the-joy rent-to-own (RTOL) stocks would be successfully converted into some cash flow even in an economic downturn.

Trump’s Expected Impact on Oil Prices

Also, it can be expected that the incoming president Donald Trump would greatly benefit from falling oil prices and the increasing global supply. On average, analysts expect Brent crude oil prices to hover around $73 for 2025. It is also likely to have a negative impact on overall stock market performance for the whole of next year.

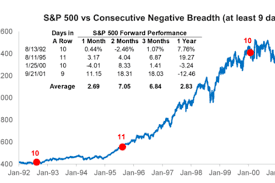

Bad Breadth in the S&P 500

The general rally that brought together almost all quarters for the S&P 500 ended in the last month of the year with 408 stocks trailing on Monday. The S&P 500 Equal Weight Index, which replicates stocks devoid of the effect of large-cap stocks, also trailed behind the benchmark S&P 500.

With 408 stocks trailing on Monday, the broad rally for the S&P 500 has faded even deeper in December. The S&P 500 Equal Weight Index tracks stocks undistorted by large-cap stocks and has also trailed the benchmark S&P 500.

Nvidia’s Resurgence Amid ByteDance’s GPU Spending

Nvidia shares had been reversing after a report that ByteDance plans to spend $7 billion on AI chips in 2025. US export restrictions notwithstanding, the stock has bounced back and sends it into the green for December. It adds to the overall performance for stocks.

Stocks Settle Back Up from Session Lows

By midday on Monday, though, the three major indexes were off their session lows. The S&P 500, Nasdaq Composite, and Dow Jones each were down by about 0.7%. Nvidia’s upswing helped revive the day’s stock market performance.

Natural Gas Futures Rise as a View of a Colder January Could Build

US natural gas futures surged as fuel demand increased on expectations of a chillier January. The large one-day move also bled into the equity market, where the Energy sector was the only S&P 500 sector in the green.

Records on Wall Street in 2024

Even on a sluggish Monday, 2024 has been a record year for Wall Street. The S&P 500 achieved 57 records, putting it into the top five for most all-time highs. Good corporate earnings and the impetus from “Magnificent Seven” tech stocks — Nvidia, Tesla, Alphabet, Amazon, Apple, Microsoft, and Meta — pushed this stock market to high performance.

Tributes to Former President Jimmy Carter

The passing of former President Jimmy Carter at the age of 100 prompted the Nasdaq and New York Stock Exchange to close January 9. This day of mourning underscores the national significance of his contributions and reflects the respect shown by the financial markets.

Activity Increases in Housing Market

Housing contract activity rebounded in November as buyers adjusted to increased mortgage rates and higher levels of inventory. This has become the fourth consecutive increase after several months of loss in a row, demonstrating positive housing market dynamics on stocks. The S&P 500 is one indicator which provides an insight on stock market health. Investors as well as analysts follow trends or changes in its level because such movements can present beneficial insights for strategic moves.

RELATED NEWS

FOR VISIT MORE NEWS JUST REMBER OUR WEBSITE WHITE TREADING