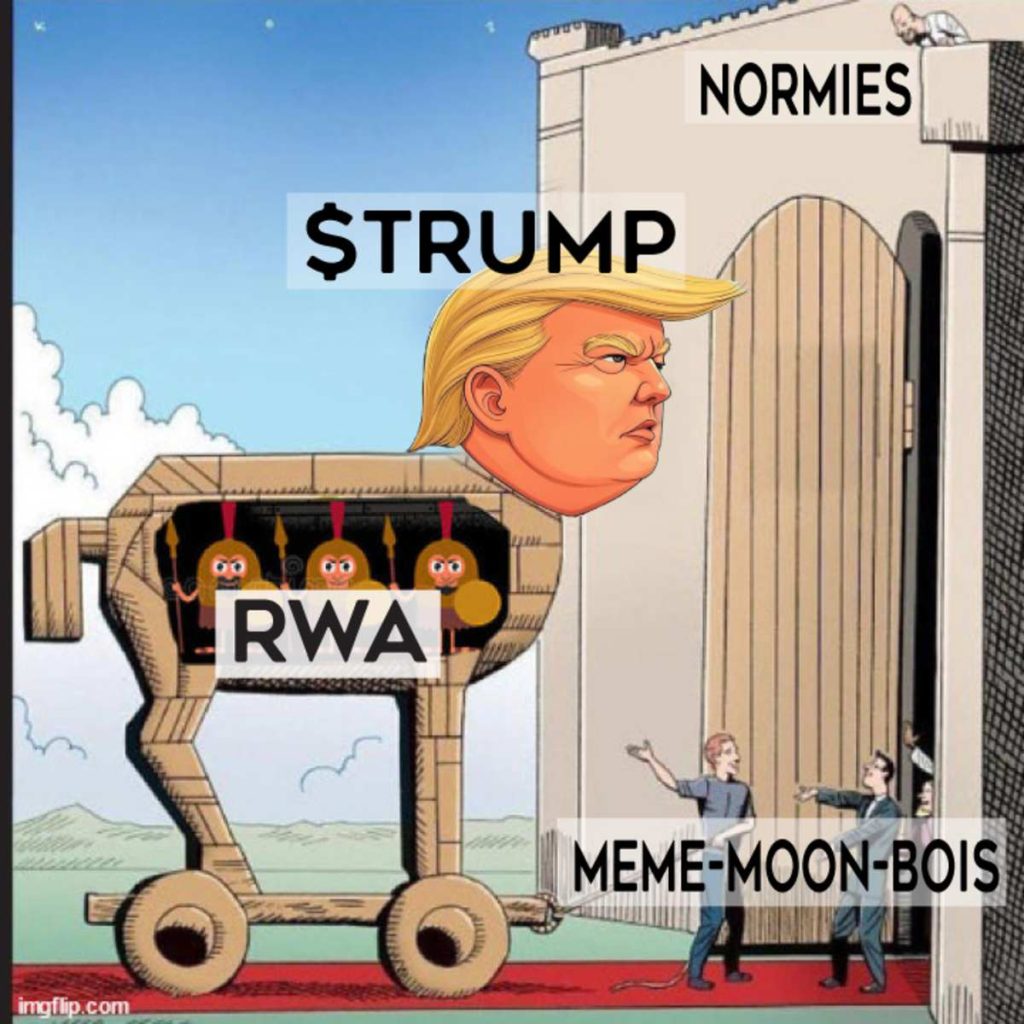

The FOMO-Driven Frenzy of Memecoins

Memecoins like the TRUMP token represent the FOMO-driven frenzy in the crypto world. Value is based on social media and cultural hype rather than hard assets. Critics say these tokens are nothing more than speculative bubbles.Billionaires Shift from Nvidia to Bitcoin

Speculative Bubbles and Memecoins

Speculative bubbles are maintained by new buyers who can continue to support prices. In the event of a bubble bursting, investors may find themselves holding little more than ‘virtual pixels’. However, DeFi is not about emotionally driven investing.

DeFi and RWA Tokens

Utility is brought in by real world asset (RWA) tokens which are back collateralized by tangibles such as real estate or art. They differ from memecoins. They do mimic TradFi investments but with blockchain advantages such as fractional ownership.

Crypto Market Dichotomy

The crypto market dichotomy mirrors traditional markets. Companies like GameStop saw stock prices soar during the 2021 short squeeze, driven by social media rather than intrinsic value. Meanwhile, tech giants like Microsoft trade at high price-to-book (P/B) ratios.

Hypocrisy in Labeling Memecoins

Comparison reveals the hypocrisy in labeling memecoins as uniquely speculative. Both TradFi and DeFi are influenced by hype and sentiment. While the TRUMP token may exemplify risk, RWA tokens demonstrate blockchain’s potential to blend speculation with true utility.

Tokenized Assets and Diversification

Tokenized assets provide the opportunity for diversification with little correlation to traditional financial assets. Research has shown that only 2.2% of future uncertainty in cryptocurrency prices is impacted by non-crypto assets. RWAs’ position as a potential counter-cyclical hedge.

Mitigating Crypto Market Volatility

Correlations between cryptocurrencies and traditional assets such as stocks, bonds, and gold remain minimal. The use of RWAs reduces crypto market volatility, thus enhancing a more balanced and resilient investment strategy.

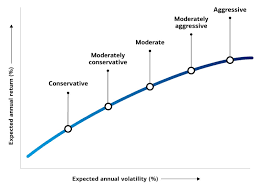

Risk Tolerance Selection

Every person has a right to risk appetite. This could be diving headlong into the ‘Wild West’ of memecoins, or it may be treading the steadier path of asset-backed investments. The evolving financial landscape calls for a nuanced grasp of risk versus reward.

Navigating Speculation and Tangible Value

As investors navigate a market where speculation and tangible value intertwine, they redefine the essence of worth in modern finance. With a clearly more crypto-friendly administration, the potential for innovation and growth in this space is immense.

Understanding Risk Tolerance

Ultimately, knowing your risk tolerance—and staying the course according to your financial compass—could be the smartest thing you do. If you enjoyed this article, please like it and share your thoughts by leaving a comment below. Also, please follow us on X (formerly Twitter) @RWA_Alpha. The best way to support us is to engage our content and join the conversation below. We are modern-day alchemists transforming complex market chatter into actionable insights.

Disclaimer

Please note, none of this article is to be construed as financial advice or an endorsement to purchase any digital assets. Do your own research and consult a professional financial advisor prior to making any investments.

Disclosure

Billionaires Flock to Nvidia Amidst Soaring Stock Many billionaire investors bought up Nvidia (NASDAQ: NVDA) stock as it soared over the past few years. Its surging sales of AI-oriented data center GPUs turned it into one of the market’s hottest growth stocks. Unsurprisingly, some big investors reduced their exposure to Nvidia after its 2,100% run over the past five years.